Payments and refunds

This guide covers the architecture and functionality of payments and refunds in Solidus, which is useful when you need to customize the payment flow or integrate with a custom payment gateway. However, Solidus comes with integrations for the major payment service providers. If that's what you're looking for, check out our Payments extensions.

Domain concepts

Solidus comes with a modular, powerful system for managing payments and refunds.

The system is designed in layers, with each layer wrapping the one below to perform an additional level of abstraction. This allows for more granular customization, and makes it flexible enough that it can be adapted to any kind of payment service provider and payment/refunds flow.

In the next paragraphs, we'll go through the main pieces that make up Solidus' payment system, and give an overview of how they work with each other.

Payment gateways

Payment gateways are the smallest unit of the payment system: each payment gateway provides the logic for integrating with the API of a specific PSP (Payment Service Provider).

Most payment gateways are built on top of ActiveMerchant, a popular Ruby library for integrating with PSPs. You can learn more about the architecture on the ActiveMerchant documentation.

Payment sources

Credit cards are the most common example of payment sources, and Solidus provide a good out-of-the-box implementation for credit-card-based payment sources.

Payment sources , as the name suggests, are models whose purpose is to store information about the different ways a user can pay.

Each payment source is backed by its own DB table and exposes different information to Solidus about the actions that can be taken on it and whether it is reusable for future payments.

Reusable payment sources can be added to a user's wallet, in which case they can be picked by the user for future checkouts as well.

Payment methods

Solidus provides out-of-the-box implementations for check and store credit payment methods, and a base implementation for credit card payment methods.

Payment methods represent different ways customers can pay in your store. For example, you may have different payment methods for PayPal and Stripe.

Different payment methods support different features, depending on the underlying PSP:

- Payment sources. Some payment methods, like check payments or bank transfers, don't need a payment source to "draw" money from, e.g. because the payment is done off-site.

- Payment profiles. Some payment methods support vaulting, i.e., the ability to store a payment source so that it can be charged later. When that's the case, Solidus will attempt to vault the payment source after creating a payment for it.

Not all payment methods are tied to a PSP. For example, the check and store credit payment methods that Solidus ships with don't need to interact with a PSP to process payments. You can think of these as "virtual" payment methods.

Solidus doesn't know much about payment gateways as such: instead, payment gateways are just "helper classes." When processing payments and refunds, Solidus interacts with the payment method, not the payment gateway—the payment method can then delegate the calls to the payment gateway with no modifications (which is the default) , or provide its own implementation that wraps the payment gateway's behavior and enriches it with additional logic.

This abstraction provides several advantages:

- It allows you to encapsulate the API interaction logic for your PSP and test it in isolation, whereas the payment method's implementation can deal with Solidus-specific details.

- It allows you to easily implement payment methods that don't use a PSP (e.g. cash on delivery), without Solidus having to know about this nuance.

- It allows you to use the store's configuration to determine how to structure the API calls to the PSP, and to enrich the API payload with store-specific information (e.g., to add your store's name to your customer's credit card statement).

Payments

The Spree::Payment

model act as a connector between user input and the rest of the payment system. Payments are

associated to an order, a payment source and a payment method.

Payments have

a state machine

that tracks the status of the payment as it goes through the regular payment processing flow.

Through

the Spree::Payment::Processing

module, payments expose a simplified API that protects the rest of the system from PSP connection

errors and data integrity issues, and integrates PSP operations with the payments state machine.

Refunds

Refunds are a critical part of an eCommerce business and they are issued on a regular basis to customers for a variety of reasons.

In Solidus, refunds are represented by

the Spree::Refund

model, and they are associated to their respective payment. Modeling refunds as a separate concept

from payments makes them very flexible and allows to use them for a broad range of use cases.

Refunds have a very simple API and they only expose

a #perform!

method.

Flow walkthroughs

Payment processing

Payment processing is tightly coupled to the payments state machine API. If you customize or replace the payments state machine, you will need to make sure that your customizations play well with the payment processing flow!

The flow for payment processing, in a standard Solidus store, is the following:

- A payment is created, either by the customer or by a store admin.

- Before the order is

completed,

process_payments_before_completemethod is called on the order. This callsprocess_payments!which, in turn, callsprocess!on all unprocessed payments. - Depending on whether the payment method uses auto-capture,

process!either authorizes or authorizes and captures the payment.

The authorize!

or purchase!

call performs

the corresponding action on the payment method

and updates the payment's state

accordingly.

At this point, all payments on the order have been processed and they're either authorized or

captured. If they're just authorized, an admin will need to capture the payment manually at a later

stage (e.g., when the order is shipped), which will call

the capture!

method.

Payment cancellation

The Spree::Payment::Cancellation

class is responsible for cancelling payments in a stock Solidus installation, but you can easily

replace it with your own.

If an order is cancelled at any point, Solidus will also "cancel" any payments on the order. The flow for payment cancellation is quite straightforward:

- When an order is cancelled,

the state machine

calls

the

#after_cancelmethod on the order. #after_cancelloops through all payments, discards the ones that have been fully refunded or are not in a cancellable state, and calls#cancel!on the remaining ones.#cancel!instantiates and run a payment canceller for the payment.

The default payment canceller has different logic depending on the state of the payment:

- If the payment has been captured, it refunds the customer ( see Refund processing).

- If the payment has only been authorized, it voids the authorization.

Refund processing

In a stock Solidus store, refunds and they can be created in different ways:

- manually via the admin UI;

- automatically, when cancelling a payment;

- automatically, when processing a reimbursement.

Some stores also have other ways for a refund to be created, e.g. through a return flow that can be initiated by the customer via the storefront or a third-party tool.

When a refund is created through the UI, via a payment cancellation or a reimbursement, Solidus will

also immediately call #perform! on the refund. This processes the refund through the original

payment's payment method and updates the payment and order accordingly.

Customizing the payment system

In the next paragraphs, we'll see how to customize different aspects of Solidus' payment system.

Note that this is an advanced use case and is only required in very specific scenarios. In most cases, you'll be better off using one of the existing payment integrations.

Custom payment gateways

Most payment integrations in Solidus don't ship with a custom payment gateway. Instead, they rely on one of the payment gateways provided by ActiveMerchant.

If you need to integrate with a PSP that's not supported by Solidus, you should first look and see whether ActiveMerchant already provides the payment gateway you need: if that's the case, you will only need to implement a custom payment method and source.

Implementing a custom payment gateway can be useful if you're integrating with a lesser-known PSP ( e.g., a local PSP in your country), or if you need to deeply customize an existing PSP integration.

The payment gateway API

Payment gateways expose the following API:

#initialize(options): initializes the gateway with the provided options. By default, Solidus will pass the payment method's preferences in here.#authorize(money, source, options = {}): authorizes a certain amount on the provided payment source.#capture(money, transaction_id, options = {}): captures a certain amount from a previously authorized transaction.#purchase(money, source, options = {}): authorizes and captures a certain amount on the provided payment source.#void(transaction_id, [source,] options = {}): voids a previously authorized transaction, releasing the funds that are on hold. Thesourceparameter is only needed for payment gateways that support payment profiles.#credit(money, [source,] transaction_id, options = {}): refunds the provided amount on a previously captured transaction. Thesourceparameter is only needed for payment gateways that support payment profiles.

All of these methods are expected to return

an ActiveMerchant::Billing::Response

object containing the result and details of the operation. Payment gateways never raise exceptions

when things go wrong: they only return response objects that represent successes or failures, and

Solidus handles control flow accordingly.

For historical and technical reasons, the Solidus API for payment gateways deviates from the ActiveMerchant API in a few ways:

- The

sourceparameter that is passed to a gateway will be an instance ofSpree::PaymentSource, while ActiveMerchant gateways expect their own models. - The

#voidand#creditmethod in ActiveMerchant never accepts a payment source. Solidus will pass the payment source to#voidand#creditif the payment method supports payment profiles. - The

#creditmethod in ActiveMerchant gateways does not accept a transaction ID but a payment method token (e.g., credit card token), since it can be used to credit funds to a payment source even in the absence of a previous charge. What Solidus calls#creditis actually called#refundin ActiveMerchant.

For custom payment gateways, these discrepancies are not a problem, since the gateways can be implemented to respond to the API expected by Solidus.

For ActiveMerchant gateways, the payment method will wrap these methods instead of delegating them to the gateway directly, and will transform the method calls and their arguments to comply with ActiveMerchant's interface.

Building your gateway

To build your gateway, you just need to create a new class that responds to the Gateway API. In this example, we'll build a new payment gateway for our beloved SolidusPay which provides a nice RESTful API for managing payments and refunds.

The first step would be to build the skeleton of our gateway. For the time being, we'll just make sure we store the API key that's passed when initializing the gateway, and we'll write a small helper on top of the HTTParty gem for interacting with the PSP's API:

module SolidusPay

class Gateway

API_URL = 'https://soliduspay.com/api/v1'

attr_reader :api_key

def initialize(options)

@api_key = options.fetch(:api_key)

end

private

def request(method, uri, body = {})

HTTParty.send(

method,

"#{API_URL}#{uri}",

headers: {

"Authorization" => "Bearer #{api_key}",

"Content-Type" => "application/json",

"Accept" => "application/json",

},

body: body.to_json,

)

end

end

end

Now that we have everything we need to interact with the API, we can start writing the actual integration. The first step in processing a payment is usually authorizing it, so we'll start with that:

module SolidusPay

class Gateway

# ...

def authorize(money, auth_token, options = {})

response = request(

:post,

"/charges",

payload_for_charge(money, auth_token, options).merge(capture: false),

)

if response.success?

ActiveMerchant::Billing::Response.new(

true,

"Transaction Authorized",

{},

authorization: response.parsed_response['id'],

)

else

ActiveMerchant::Billing::Response.new(

false,

response.parsed_response['error'],

)

end

end

private

# ...

def payload_for_charge(money, auth_token, options = {})

{

auth_token: auth_token,

amount: money,

currency: options[:currency],

description: "Payment #{options[:order_id]}",

billing_address: options[:billing_address],

}

end

end

end

The logic for the #authorize method is fairly straightforward: it makes a POST request to

the /api/v1/charges endpoint of the PSP's API. The body of the request includes information about:

- the amount we want to charge, which is passed in the

amountparameter as a number of cents ( e.g.,1000represents 10.00,1050represents 10.50), - the payment source we want to charge, which is passed in the

auth_tokenparameter, - metadata about the order and the payment

, which is passed in the

optionsparameter.

The method then returns an ActiveMerchant::Billing::Response object that represents the success or

failure of the operation. In the successful response, the :authorization option will also be

included. Solidus will store the value of this option on the response_code attribute on

the Spree::Payment record, so that we can reference the transaction ID when

capturing/voiding/refunding it later.

You'll notice that the payload of the request is generated in a helper method, #payload_for_charge

. This is because the payloads for authorizing and purchasing (i.e., authorizing and capturing in

one go) is the same, minus the :capture option, which we'll set to true when we also want to

capture the amount:

module SolidusPay

class Gateway

# ...

def purchase(money, auth_token, options = {})

response = request(

:post,

"/charges",

payload_for_charge(money, auth_token, options).merge(capture: true),

)

if response.success?

ActiveMerchant::Billing::Response.new(

true,

"Transaction Purchased",

{},

authorization: response.parsed_response['id'],

)

else

ActiveMerchant::Billing::Response.new(

false,

response.parsed_response['error'],

)

end

end

# ...

end

end

Some PSPs, such as Stripe, provide a single endpoint for authorizing and capturing a payment in one

request. Others will require you to perform two different requests, in which case your #purchase

method may simply call #authorize and #capture in succession.

The rest of our gateway (#capture, #void and #credit) is trivial and pretty similar to our

existing methods. We just call our PSP to perform a certain operation on an existing transaction:

module SolidusPay

class Gateway

# ...

def capture(money, transaction_id, options = {})

response = request(

:post,

"/charges/#{transaction_id}/capture",

{ amount: money },

)

if response.success?

ActiveMerchant::Billing::Response.new(true, "Transaction Captured")

else

ActiveMerchant::Billing::Response.new(

false,

response.parsed_response['error'],

)

end

end

def void(transaction_id, options = {})

response = request(:post, "/charges/#{transaction_id}/refunds")

if response.success?

ActiveMerchant::Billing::Response.new(true, "Transaction Voided")

else

ActiveMerchant::Billing::Response.new(

false,

response.parsed_response['error'],

)

end

end

def credit(money, transaction_id, options = {})

response = request(

:post,

"/charges/#{transaction_id}/credit",

{ amount: money },

)

if response.success?

ActiveMerchant::Billing::Response.new(true, "Transaction Credited")

else

ActiveMerchant::Billing::Response.new(

false,

response.parsed_response['error'],

)

end

end

# ...

end

end

At this point, we have our custom payment gateway which encapsulates all API interaction logic with the PSP, and we can use it as part of a custom payment method.

Custom payment sources

Not all payment methods require a custom payment source. Instead, you may want to simply rely on the

existing Spree::CreditCard

payment source, which provides some useful logic for working with "credit card" types of payment

sources.

Creating a custom payment source may be needed if you are integrating with a new PSP that is not credit-card based. This will be the case, for instance, when a customer pays through their PSP account's balance rather than via a specific credit card (e.g., "Pay with PayPal"). It's also a common setup with financing PSPs such as Affirm or AfterPay: in this case, the PSP itself is the " source" of money.

The payment source API

Payment sources respond to a very simple API which tells Solidus what operations can or cannot be performed on the payment source. Solidus will use this information to display/hide certain actions on the backend, or to control the order processing flow:

#actions: returns an array of actions that can generally be performed on payments with this payment source.capture,voidandcreditare standard supported actions, but you can also have custom actions here, as long asSpree::Paymentresponds to them.#can_<action>?: for each of the actions returned by#actions, Solidus will attempt to call this method to verify whether that action can be taken on a payment, which will be passed to the method as the only argument. Default implementations are provided forcapture,voidandcreditwhich check the payment's state.#reusable?: whether this payment source is reusable (i.e., whether it can be used on future orders as well). Solidus will use this to determine whether to add the payment source to the user's wallet after the order is placed, and to determine which sources to show from the user's wallet during the checkout flow.

Next, let's see how exactly to implement these methods in a brand new payment source.

Building a custom payment source

For example, let's say we're integrating with a brand new PSP called SolidusPay which allows customers to pay with their SolidusPay account's balance, similar to what happens with PayPal. In order to model this behavior, we'll need a custom payment source model, which will be much simpler than the default credit card payment source.

The first step is to generate a new model, which we'll call SolidusPay::Transaction.

Our model will just have a payment_method_id column, which will be used to associate the payment

source to the payment method that generated it, and an auth_token column, which we'll use to store

the ID of the SolidusPay auth token that we will later charge:

$ rails g model SolidusPay::Transaction payment_method_id:integer auth_token:string

$ rails db:migrate

By default, Rails will generate a model that inherits from ApplicationRecord. Instead, we want our

model to inherit from Spree::PaymentSource, so that we can benefit from some sensible defaults

provided by Solidus for payment sources:

- class SolidusPay::Transaction < ApplicationRecord

+ class SolidusPay::Transaction < Spree::PaymentSource

+ self.table_name = "solidus_pay_transactions"

end

At this point, we have our new payment source model ready. Now, let's implement the payment source

API, so that Solidus knows how to use our payment source during order processing (note that this

logic is taken verbatim from Spree::PaymentSource, other than the #reusable? method which would

normally return false):

class SolidusPay::Transaction < Spree::PaymentSource

# ...

# SolidusPay payments can be captured, voided and refunded.

def actions

%w(capture void credit)

end

# A SolidusPay payment can be captured as long as it's in the checkout or pending state.

def can_capture?(payment)

payment.pending? || payment.checkout?

end

# We rely on the payment state machine to determine when a SolidusPay payment can be voided.

def can_void?(payment)

payment.can_void?

end

# A SolidusPay payment can be refunded if it's been captured and if the

# un-refunded amount is greater than 0.

def can_credit?(payment)

payment.completed? && payment.credit_allowed > 0

end

# SolidusPay accounts can be used to pay on future orders as well.

def reusable?

true

end

end

At this point, we have a new payment source and Solidus knows how to use it internally.

Custom payment methods

Payment methods are what Solidus interacts with when processing payments and refunds. In order to take advantage of a custom payment gateway, we'll also need a custom payment method.

The payment method API

By

default, Spree::PaymentMethod delegates

all gateway-specific method calls to the gateway itself. You can choose to maintain this behavior,

or to wrap the calls and enrich them with your custom logic by re-defining the relevant methods (

e.g., #authorize, #capture, #purchase etc.).

A common setup is to code your payment gateway so that it doesn't have to know about payment sources and can be used independently, while the payment method acts as a bridge between payment sources and the calls to the payment gateway.

Payment methods also expose additional methods which are Solidus-specific and not part of the standard gateway API. We'll see which in the next paragraphs.

Building a custom payment method

The first step for building a custom payment method is to create a new model that inherits

from Spree::PaymentMethod. Unlike for payment sources, payment methods are all stored in one

table, so there's no need to use the model generator. Instead, we'll create the model class

directly, with the bare minimum that's needed to make it work:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

end

After creating the model, it's a good idea to configure the translation for its name, so that Solidus knows how to display the payment method's name properly in the backend:

en:

# ...

activerecord:

models:

solidus_pay/payment_method: Solidus Pay

Now that we have our new payment method, we need to tell Solidus about its existence, so that SolidusPay shows up when an admin attempts to configure a new payment method:

Spree.config do |config|

# ...

config.environment.payment_methods << 'SolidusPay::PaymentMethod'

end

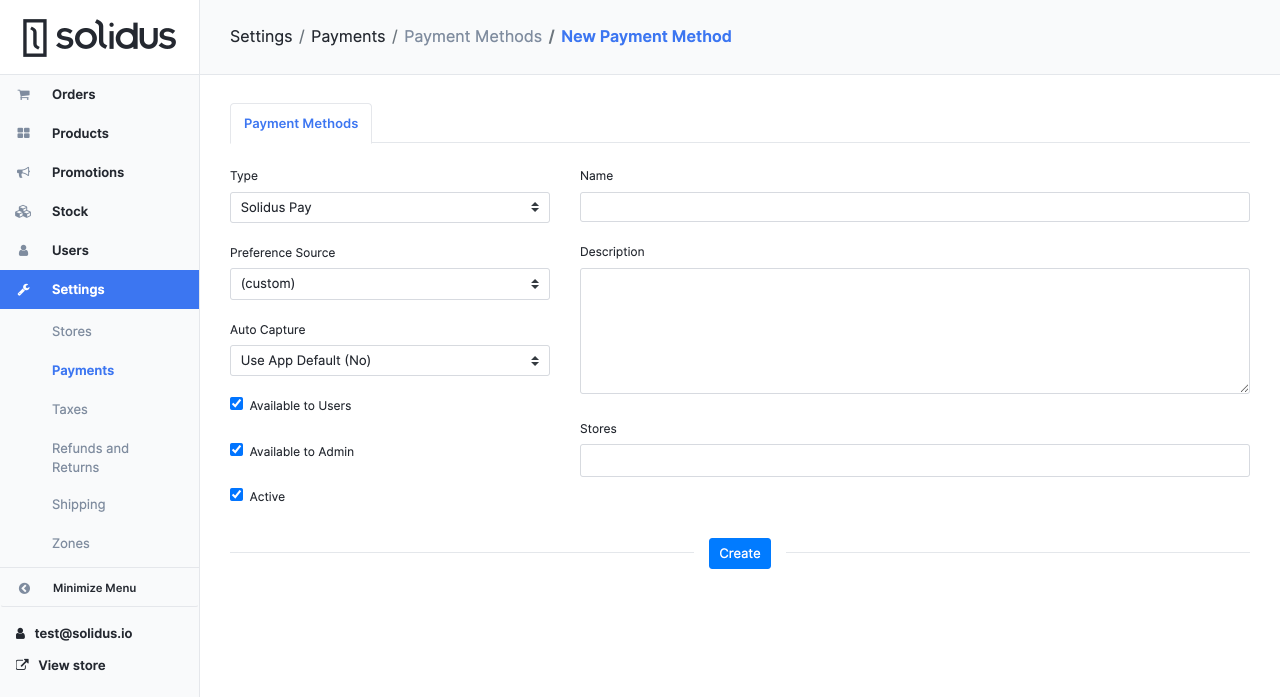

At this point, if you open your Solidus backend and navigate to Settings → Payments → New Payment Method, you should see "Solidus pay" in the list of available payment methods:

Fill in a name for your payment method ("Solidus Pay" will do just fine) and hit Create to create a new instance of the payment method in your Solidus store.

It's common to need to store some credentials or other preferences associated with a payment method. Please, see the section about statically configured models for details.

At this point, however, the payment method is just an empty shell: it doesn't know anything about the custom source or the custom gateway we have implemented. We still need to make some adjustments in order to fully integrate it with our PSP.

Integrating a custom payment source

The first step to a complete integration is to make our payment method aware of the custom payment source model we have created earlier. This way, the payment method will know which sources to retrieve and create during the checkout flow.

To integrate the payment method with our payment source, we'll implement the following methods:

#payment_source_class: returns the payment source class the payment method works with.#reusable_sources(order): given a payment source, returns whether the payment method can work with it.#supports?(source): _**_given an order, returns the list of reusable sources on the order for the payment method.

The implementation for these is pretty simple and self-explanatory:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def payment_source_class

SolidusPay::Transaction

end

def supports?(source)

source.is_a?(payment_source_class)

end

def reusable_sources(order)

return [] unless order.user

order.user.wallet_payment_sources.map(&:payment_source).select do |source|

supports?(source) && source.reusable?

end

end

end

Integrating a custom payment gateway

In order to start using our custom payment gateway, we'll need to tell the payment method which

payment gateway class to initialize. We can do this by defining a gateway_class method on the

payment method:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

preference :api_key, :string

def gateway_class

SolidusPay::Gateway

end

end

You will notice that we also added an api_key preference. This preference will be automatically

configurable via the payment method UI in the Solidus admin, and will be passed to the payment

gateway's #initialize method. By default, the payment method will delegate all #authorize

, #capture, #purchase, #void and #credit calls to the gateway.

However, there's one caveat: Solidus will pass instances of SolidusPay::Source to our payment

method when calling #authorize and #capture, but the gateway doesn't know anything about payment

sources and works directly with auth tokens instead. This makes the gateway independent of Solidus,

but it also means Solidus will pass the wrong type of argument to it.

To accommodate this discrepancy, we'll adjust the #authorize and #capture methods on the payment

method slightly, in order to transform payment sources into auth tokens:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def authorize(money, source, options = {})

gateway.authorize(money, source.auth_token, options)

end

def purchase(money, source, options = {})

gateway.purchase(money, source.auth_token, options)

end

end

Finally, we need to implement the #try_void method. This method is supposed to attempt to void a

payment or return false if the payment cannot be voided anymore (in which case, Solidus will issue

a refund instead):

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def try_void(payment)

return false if payment.completed?

void(payment.source.transaction_id)

end

end

Our try_void implementation is pretty simple: if the payment has already been completed (i.e.,

it's been captured), we return false and let Solidus issue a refund. If the payment hasn't been

captured, we void the existing authorization instead.

Providing payment method partials

These partials assume that you haven't customized the backend, storefront or API in significant ways which would prevent them from working/displaying properly. If you have applied extensive customizations to either of these engines, make sure to adjust the partials accordingly!

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def partial_name

'solidus_pay'

end

end

When you create a new payment method, Solidus has no idea how to actually display it in the storefront, backend or API. You will need to provide payment method partials so that Solidus can use them when displaying the SolidusPay payment method.

The first partial we'll implement is used by Solidus when displaying the SolidusPay payment form in the checkout flow. We will just ask users for their SolidusPay auth token:

<% param_prefix = "payment_source[#{payment_method.id}]" %>

<div class="field field-required">

<%= label_tag "auth_token_#{payment_method.id}", 'SolidusPay Auth Token' %>

<%= text_field_tag "#{param_prefix}[auth_token]", nil, { id: "auth_token_#{payment_method.id}" } %>

</div>

We'll also need to add auth_token as a permitted source attribute in order for

it to get accepted by Spree::CheckoutController:

Spree::PermittedAttributes.source_attributes << :auth_token

When users fill this form during checkout, Solidus will create a new SolidusPayAccount payment

source with the auth token provided by the user. In general, Solidus will copy all

the #{param_prefix}[...] attributes to the payment source, so you can add more columns to the

payment source model and Solidus will set them all as long as your field names are structured

properly.

For the sake of simplicity, we are assuming paying via SolidusPay is as simple as providing your auth token in clear text. In reality, things are usually slightly more complicated and require integrating with a JS SDK or redirecting the user to an off-site page in order to get a payment token. It doesn't matter how complex your payment scenario: as long as it results in a payment source being created with the right information, Solidus can integrate with it.

But what if our user already has a SolidusPay account in their wallet, and they want to use that instead? That requires another partial:

<tr id="<%= dom_id(wallet_payment_source, 'solidus_pay') %>">

<td><%= wallet_payment_source.payment_source.auth_token %></td>

<td>

<%= radio_button_tag "order[wallet_payment_source_id]", wallet_payment_source.id, default, class: "existing-cc-radio" %>

</td>

</tr>

Here, we are simply showing a radio button which Solidus will render to the user for all SolidusPay accounts. The user can check one of the radio boxes to pay with an existing payment source.

At this point, it's possible to pay with a new or existing SolidusPay account via the storefront. Let's make sure the same can be done in the backend, for orders placed manually by an admin.

This is what the partial for the backend looks like:

<fieldset class="no-border-bottom">

<legend><%= payment_method.name %></legend>

<% if previous_cards.any? %>

<div class="field">

<% previous_cards.each do |solidus_pay_account| %>

<label>

<%= radio_button_tag :card, solidus_pay_account.id, solidus_pay_account == previous_cards.first %>

<%= solidus_pay_account.auth_token %>

<br />

</label>

<% end %>

<label>

<%= radio_button_tag :card, 'new', false %>

Use new SolidusPayAccount

</label>

</div>

<% end %>

<% param_prefix = "payment_source[#{payment_method.id}]" %>

<div class="field">

<%= label_tag "auth_token_#{payment_method.id}", 'Auth Token', class: 'required' %>

<%= text_field_tag "#{param_prefix}[auth_token]", '', class: 'required fullwidth', id: "auth_token_#{payment_method.id}" %>

</div>

</fieldset>

As you can see, this partial covers both new and existing payment sources. The admin can either select one of the existing payment sources, or they can enter the customer's SolidusPay auth token to create a new payment source.

For many payment sources, it won't be possible to create a new source from the backend (e.g., it wouldn't make sense to let admins link a customer's PayPal account via the backend, since they wouldn't have the customer's PayPal credentials). In this case, it's perfectly fine not to display the form at all, and only let admins choose from existing payment sources.

We need one more partial for the backend, which will be used by Solidus when displaying a payment source's information to admins:

<fieldset>

<legend align="center"><%= SolidusPayAccount.model_name.human %></legend>

<div class="row">

<div class="col-4">

<dl>

<dt>Auth token:</dt>

<dd><%= payment.source.auth_token %></dd>

</dl>

</div>

</div>

</fieldset>

Here, we are just displaying the SolidusPay auth token, so that admins can easily understand which payment source was used on a particular payment.

Finally, the last partial is needed to display a payment source's information via the API. Again, we'll just include the payment source's ID and the SolidusPay auth token, so that the payment source can be properly rendered by e.g. a mobile/JS application that uses the Solidus API:

json.call(payment_source, :id, :auth_token)

Adding support for payment profiles

Payment methods in Solidus can support payment profiles. Payment profiles provide the ability to vault a payment source, i.e. store its details permanently in the PSP so that it can be charged at a later stage. If you've ever used Stripe, this would be the equivalent of creating a Stripe customer associated to the credit card you're trying to charge (in fact, that's exactly what the Stripe payment method in Solidus does!).

When a payment method supports payment profiles, Solidus will alter the usual payment processing flow slightly to accommodate that:

- Right after creating a payment, Solidus

will call

the

#create_payment_profile(payment)method on the payment method. This method is supposed to create a payment profile for the payment source on the payment, and save its details on the payment source.

When voiding

or refunding a

transaction, Solidus will pass the payment source to the #void or #refund call, so that the

payment gateway can include the payment profile ID in the PSP API call, if required by the PSP.

The first step for adding support for payment profiles is defining

the #payment_profiles_supported? method in our payment method:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def payment_profiles_supported?

true

end

end

Next, we'll implement a create_customermethod in our gateway, which accepts a SolidusPay auth

token and creates a new SolidusPay customer from it:

class SolidusPay::Gateway

# ...

def create_customer(auth_token)

request(

:post,

"/customers",

auth_token: auth_token,

).parsed_response

end

end

This method will return the customer's profile, and we'll assume that the customer ID we want to

store will be in the id key.

At this point, we'll need to add a column to our SolidusPay::Transaction model for storing the

SolidusPay customer ID:

$ rails g migration AddCustomerIdToSolidusPayTransactions customer_id:string

$ rails db:migrate

At the moment, Solidus doesn't offer native data structures for associating multiple payment sources to the same payment profile (e.g., associating the same Stripe customer to multiple credit cards). However, this could easily be implemented as a custom functionality (e.g., by storing the Stripe customer ID on the user rather than the payment source).

Finally, we'll implement the create_profile method on the SolidusPay payment method. This method

will be called right after a new SolidusPay payment is created, and it should create a new

SolidusPay customer with the payment source associated to the payment method, and store its ID on

the corresponding transaction:

class SolidusPay::PaymentMethod < Spree::PaymentMethod

# ...

def create_profile(payment)

customer = gateway.create_customer(payment.auth_token)

payment.source.update(customer_id: customer['id'])

end

end

Solidus should now create a new customer profile in SolidusPay whenever we create a SolidusPay payment, and the customer ID will be correctly associated to the payment source.

The last step is updating the payment gateway and payment method implementation: now that our

payment method supports payment profiles, Solidus will start passing the payment source as an

additional parameter to #void and #credit:

class SolidusPay::Gateway

# ...

- def void(transaction_id, options = {})

+ def void(transaction_id, source, options = {})

# ...

end

- def credit(money, source, transaction_id, options = {})

+ def credit(money, source, transaction_id, options = {})

# ...

end

end

In our example, we are not doing anything with the source parameter and simply accept it so that

Solidus' method calls don't fail. In the real world, we may want to pass the customer ID to the

gateway along with the transaction ID, so that it can be included in the API payload.

Custom payment canceller

If you need to customize the logic that is used for payment cancellation, you can easily do it via a configuration hook.

For this example, we are going to assume that, instead of refunding customers on the original payment method, you want to offer them store credit instead.

In order to accomplish this, you will first need to create a custom payment canceller:

module AwesomeStore

class PaymentCanceller

def cancel(payment)

# Capture the payment. If the payment has already been captured,

# this will be a no-op.

payment.capture!

# Find or create an "Order cancellation" store credit category.

category = Spree::StoreCreditCategory.find_or_create_by(

name: 'Order cancellation',

)

# Create a store credit for the payment amount.

Spree::StoreCredit.create!(

user: payment.order.user,

amount: payment.credit_allowed,

category: category,

currency: payment.currency,

created_by: payment.order.canceler,

)

end

end

end

The cancellation logic is pretty simple: first of all, we capture the payment, unless it's already been captured. Then we generate a store credit for the payment amount. Customers will then be able to spend the store credit on their next order.

In order for Solidus to start using our canceller, we need to specify it in our initializer:

Spree.config do |config|

# ...

config.payment_canceller = AwesomeStore::PaymentCanceller.new

end

You can test your new canceller by placing and cancelling an order from the Solidus backend: you'll see that, instead of the payment being refunded, a store credit will be generated instead.